I almost feel like I should put some huge banners on this blog, to stress that it contains my PERSONAL ideas about investing, politics and money. And that I am not claiming to be an expert in any of it. Just a private investor that follows the news, the markets, and has certain ideas about all of that. And that copying anything I do could be a bad idea.

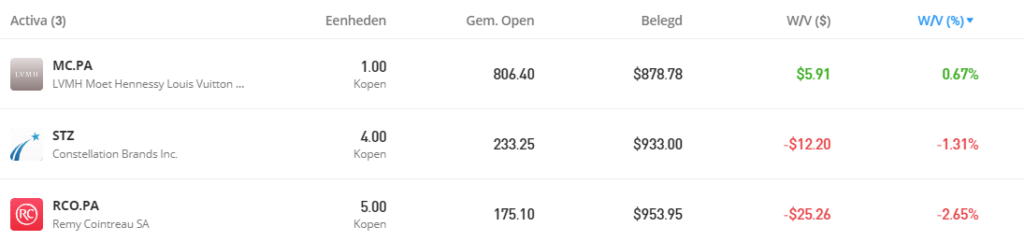

Because of course, like in a lot of cases…some of the stock in my virtual portfolio went down the moment I bought it. That’s not very shocking to me, because that is what stocks do. They go up and down. And I think my choices will be up in the long run. So , given they were bought about a week ago, this says absolutely…nothing. Let’s take a look at the portfolio with a drinking problem.

Yeah, that is not a spectacular start, I must admit. However, if you are looking for spectacular, I would recommend the circus. I can not remember who said it, but a n experienced and successful investor once said in an interview that if your investments are exiting, you are doing it wrong. It might have been Warren Buffet, that would not be out of character. Any way, I read it and liked it, and try to follow that mostly. Wealth vs being rich.

Now, it is cold in my country, and I think people in my hemisphere will buy comfort food. So it is time to expand with some shares of companies that are targeting our stomachs and throats. So lets add some Starbucks! And since fast food is of course comfort food, we will also get some McDonalds.

While I add more stocks in the coming weeks, the portfolio will also become less vulnerable for market dips, but one thing will of course not change, and that this is a consumer goods portfolio, and parts of it will be very cyclical. But that is the think I want to explore here, is that an issue if you hold on long enough? It should not…