14 April, 2023

2023/04/14

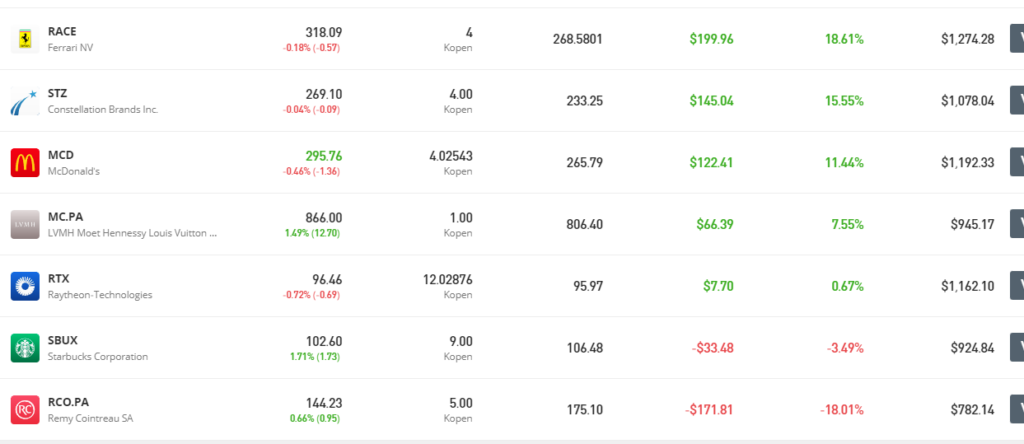

So…the unethical portfolio is starting to look a lot better. Especially of course the Louis Vuiton shares are looking mighty fine! So, if we want to learn something from this as investors, we should see it as an absolute positive if the head office of a company is besieged by an angry mob of strikers! If the French unions are saying that it is where the money is, if they paint the company as disgusting profiteers…strong Buy!

And of course, I am verry happy that I have no Anheuser-Busch-Inbev. Our Constellation shares may be down a percentage of three, but that’s not like the beating of 50% that Inbev received. So the question may be, buy on the low? Buy when the blood runs through the streets?

Don’t think so. The patient is still bleeding through the stitches. And the stitches are done with cotton candy it seems. The objective of this experiment is to see if a lazy, unethical investor gets a nice return. So I have no desire to put any energy in trying to time when that company is a buy again.

Of course, that’s just an opinion, and I did not go to business school, and I am not a financial professional….but my gut tells me not to trust a company that basically calls a big, loyal, existing client base knuckle-dragging throwbacks. I have limited time to check up on my investments. I will not waist time on companies I lose trust in. I will be wrong sometimes, sure, but I think it works for a small private investor!

You can decide that a brand is so close to death, that you need to make a 180 degree turn. It has happened in the past. And with success. Sometimes. Success is not guaranteed. It sometimes fails and kills the brand. If you do it, you better be sure that the current buyers are a quickly dwindling group, that are keeping new buyers from trying it. And that your new target audience is actually interested in your product. So for me, it fails on both counts.

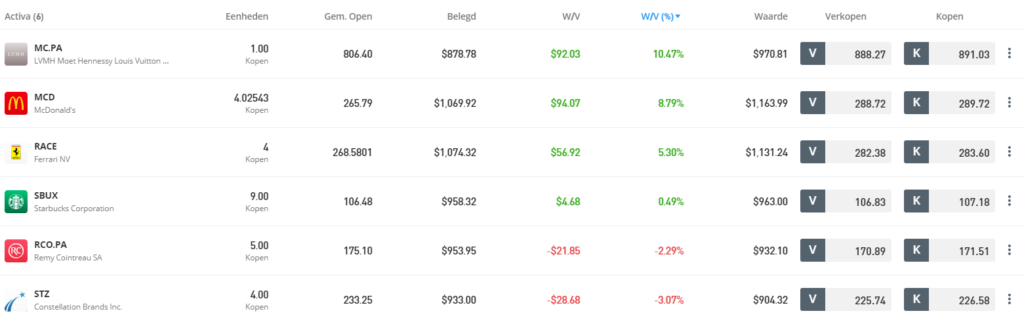

Update: 21 juli

I spent very little time even thinking about this portfolio the last couple of months actually. I bought some more stock, and that is about it. Had some vacation time, amongst other things. I added Raytheon, because defense technology is in a lot of people’s eyes unethical, and they seem to be good at making money.

I am very happy to see that Constellation Brands recovered, it should perform well in the summer of course. The average result is now a bit disappointing 4,8 percent, but when RCO picks up, we should be looking a lot better.